- | 9:00 am

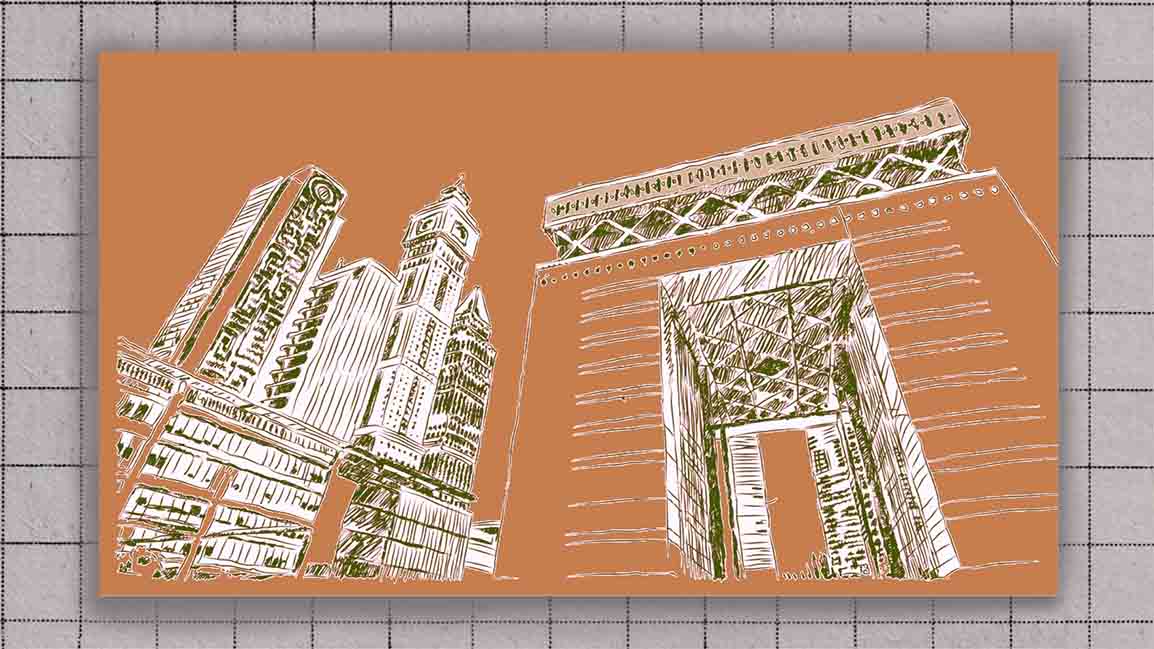

Dubai’s stock exchange is bouncing back. This is why it is good for the economy

The DFM is dominated by financial services and property companies and has rallied more than 22% in the last 12 months.

When Dubai launched its stock exchange – Dubai Financial Market (DFM) – in 2000, it had nine companies launching their initial public offerings (IPOs) and listing on the exchange. In five years, the bourse soared to a total market capitalization of $120 billion, almost three times the size of Dubai’s gross domestic product, with 11 companies lined up to raise funds through the exchange.

The burgeoning stock market reflected the euphoria in the economy. The momentum continued for the next few years, with eight listings in 2006, 10 in 2007, and six in 2008, and increased listings and investor participation on the exchange.

The global financial crisis, however, weighed down investor activity on the exchange. Even when the economy bounced back from the crisis, the Dubai stock market failed to pique investors’ interest. Between 2010 and 2021, only nine IPOs were introduced to the DFM.

To lend perspective to these numbers, in the developed stock markets, notably the US, the number of companies vying to list on the exchanges is far higher. For instance, there were more than 1,000 IPOs on the US stock exchanges last year.

The Abu Dhabi Securities Exchange and Saudi Arabia’s markets have grown multi-folds in the region. The current market cap of ADX is $528.2 billion compared with the $149.51 billion in DFM.

Therefore, the government’s plan to reinvigorate the Dubai stock market by nudging government companies to list is a significant move.

The enthusiastic response to DEWA’s public offering shows investor appetite for good companies and businesses. DEWA’s IPO was the largest in the Middle East since Saudi Aramco in 2019, and the shares jumped 16% on its debut. In July, Union Coop became the first consumer cooperative in the UAE to list its shares on the DFM.

DEVELOPING THE ECONOMY

Though overdue, the move to bring more companies to the bourses is shrugging off the inertia. It has the potential to develop the stock market into a preferred medium for companies to raise funds and for residents to invest.

In principle, a well-functioning stock market helps the development process in an economy in various ways, including encouraging savings by providing households with an additional instrument that may better meet their risk preferences and liquidity needs.

“The stock market not only offers an easy means for businesses to raise capital and for people to accumulate wealth, but it also promotes economic progress and national prosperity by limiting the scope of corporate regulation,” says Vijay Valecha, chief investment officer at Century Financial.

“Due to Expo 2020, Dubai’s economic growth has been bolstered by increased tourist traffic, lavish retail spending, and significant real estate investments. The city is pursuing a Trojan Horse move to invest in the financial markets and announce a flurry of IPOs to establish itself as a leader among other Gulf countries. The UAE is ideally prepared to take advantage of the opportunities to end 2022 on a high note,” adds Valecha. “It has been overdue for DFM to expand, and the exchange has seen a flurry of IPOs since DEWA was listed.”

Until July 2019, volumes on DFMGI (Dubai Financial Market General Index) were at $3.17 billion. After several federal initiatives such as long-term visas, corporate tax initiatives, and globally aligned weekends, DFMGI marked the highest volume in November 2021, with $12.74 billion. “The city is taking several measures to strengthen capital markets within country borders. The emirate also unveiled plans to set up a market maker fund to encourage listing more private companies from the energy, logistics, and retail sectors. The UAE markets are experiencing an interesting period as several variables combine to favor IPOs,’ says Valecha.

Additionally, DFM’s substantial efforts to improve market accessibility and shorten the on-boarding process for investors heavily rely on digital transformation. “The DFM’s extensive investment in numerous innovative connectivity solutions and enhancements has increased new DFM Investor Numbers by 100% during 2021, of which 63% are foreign investors. More listings will improve local volumes and allow more foreign participation to flow into the country,” adds Valecha.

WEALTH CREATION FOR COMPANIES

The top 20 stock markets in terms of trading volumes boast a market capitalization of over a trillion dollars. The vision of the Dubai government is to increase the market size to over $800 billion.

“A buoyant market results in wealth creation for companies and shareholders. This puts a lot of free cash in people’s hands, which they can use for further investments. Overall, it’s good for the economy,” says Lakshmana Swamy, co-founder, MyMoneySouq.

Besides, a healthy stock exchange also promotes good governance in business practices and investment in sustainable development. “Good governance in the twenty-first century means good practices on environmental, social and corporate governance issues—what many investors refer to as ESG issues,” says James Zhan, director of the Investment and Enterprise Division, United Nations Conference on Trade and Development.

The Dubai government plans to list Salik and a business park operator in the coming months. Businesses within Emirates Group, including dnata and Skywards loyalty program and Dubai airport’s Duty Free, have also been rumored to be among those being considered for public offer.

“The government is looking into a number of options to draw in more ordinary investors as the local financial markets are finally expanding. The choice to permit cooperative listings was made in response to the local bourses’ success in drawing investors from inside and beyond the nation. More involvement boosts investor confidence in stocks. More purchasing occurs, which may also contribute to an increase in price. Additionally, the increase in activity will encourage liquidity, enhancing trade effectiveness and better serving issuers and investors in their markets,” says Valecha.

In terms of investor ratio, retail and HNWIs (high net worth individuals) play a key role in liquidity on DFM, accounting for around 48% of trading. This includes local and international investors. Foreign ownership accounts for 23% of the DFMGI market capitalization, and local investors command the remaining 77%. Additionally, 82% of the market cap is held by institutional investors, giving retail investors a share of 18% as per the Q1 2022 estimates shared by DFM.

“It is common to see retail investors contributing to only 10% of the market cap in emerging markets, whereas a number above 20% for developed markets isn’t unusual. The UAE is faring well and is moving from the emerging market trend towards a developed one,” says Valecha.

GDP grows faster in economies with liquid stock markets. The government is doing its bit. This year, the trading days changed from Sunday to Thursday to Monday to Friday, according to international standards. The DFM and ADX are open from 10 am to 3 pm.

The market maker fund worth 544.6 million is to encourage listings from sectors such as energy, logistics, and retail. Abu Dhabi is also launching a $1.3 billion IPO fund to help encourage and support private companies to list on the local stock market. This would potentially draw more foreign investments into the region and likely boost local markets’ liquidity and depth.

The DFM is dominated by financial services and property companies and has rallied more than 22% in the last 12 months. If this momentum continues, this year could again give stellar returns to investors.