- | 9:00 am

Middle East firms are aiming for net zero. Can they achieve it?

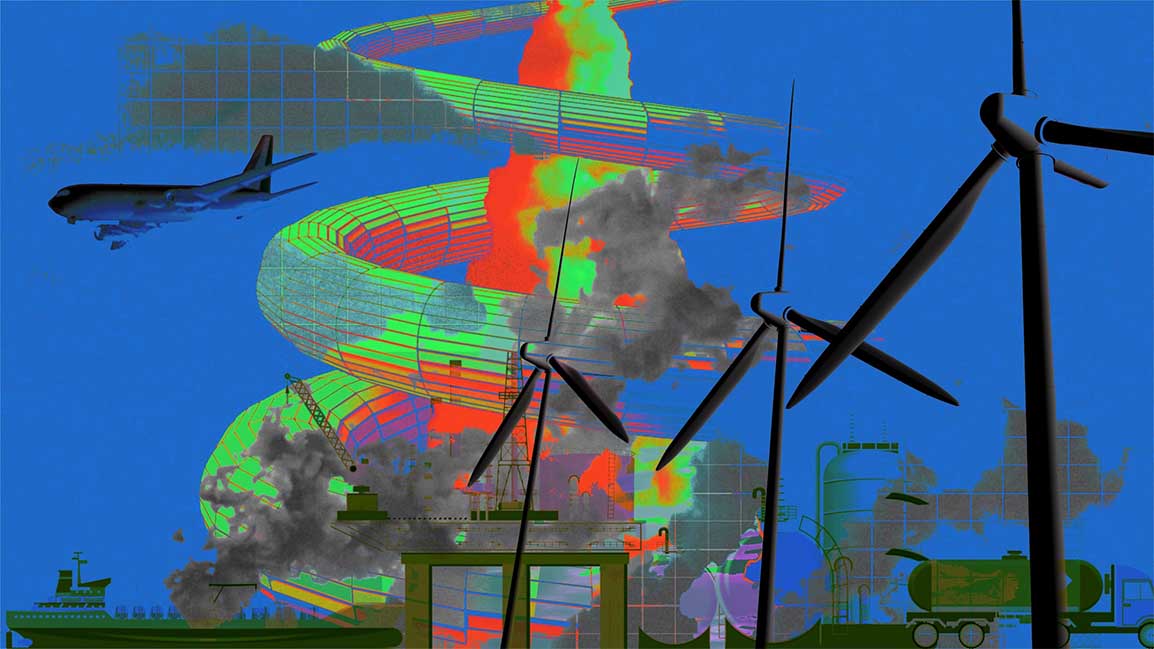

A minor emitter, the aviation sector is closer to achieving sustainable goals, while oil producers, the largest emitters, are catering to the rising demand for fossil fuels.

In the Middle East, a number of companies have set net-zero climate goals—meaning that they’ll cut their CO2 emissions as much as possible. According to climate scientists, society as a whole needs to reach net zero by the middle of the century, at the latest, to avoid the worst impacts from climate change. That means that businesses have to do the same. But when companies set net-zero goals, some plans are more credible than others.

Cement is responsible for 8% of total carbon emissions, so construction firms building skyscrapers can’t undo the environmental impact just by planting trees. Further, the oil and gas industry is intrinsically tied to emissions. So, the need arises to ask what the game plan is for these industries to stop CO2 from reaching the atmosphere.

“Countries of the region remain amongst the highest emission producers per capita, with the limited short-term target that falls behind the 1.5C Paris Agreement Target,” says Dr Akram Awad, a partner at the Boston Consulting Group (BCG).

The war in Ukraine and the resultant blockade on oil and natural gas from Russia has triggered a battle to save energy, with the need for climate action as collateral damage.

Germany has again started firing coal power plants over anxieties about running out of natural gas. Conflict-induced inflation in energy costs has increased demand for fossil fuels, worrying countries about missing their emission cut targets. If fossil fuel companies increase production to meet the demand created by the Ukraine war, what becomes of their ambitious net-zero goals?

Sure symbolic gestures such as campaigns, the announcement of emission targets, and the formation of committees are enough for greenwashing to raise a firm’s market value. But are the companies bringing about organic change through concrete climate action? If they are, what do they have to show for it?

“While all sectors in the Middle East still have a long way to go to put themselves on track for the national net-zero targets, the major players in the energy and industrial sectors have advanced in incorporating climate action in their agendas,” says Awad.

Do firms in the Middle East have blueprints, long-term strategies, frameworks for implementation, and the technology to do it? Most importantly, who measures the impact of these plans and how close the region’s businesses are to achieving their promised targets?

This is where National Quality Assurance (NQA) comes in to ensure that sustainability isn’t reduced to greenwashing. Present in 90 countries, the organization describes carbon neutrality as a state where a firm takes more carbon out of the environment than it emits. It mentions that using efficient tech, switching to low-carbon energy, and using renewable power for operations might require a complete overhaul of business models.

NQA uses a two-stage audit process to certify organizations on carbon neutrality and adheres to hundreds of ISO standards that help organizations achieve net-zero status. It also mentions that while companies focus on reducing carbon emissions, the absorption of CO2 is a science still taking shape. The technology available for carbon capture and storage and tools such as carbon dioxide scrubbers isn’t still commercially viable.

Among diverse sectors, the international accreditation organization cites aviation as one that’s rethinking its practices and tech.

SMALL CONTRIBUTORS ELEVATING CLIMATE ACTION?

The aviation sector may account for only 2.5% of the world’s carbon emissions, but the industry has been incorporating massive changes into operations to protect the climate. From turbulence awareness that leads to lower energy consumption by aircraft to biofuels used for flights, airlines in the Middle East are raising climate action levels.

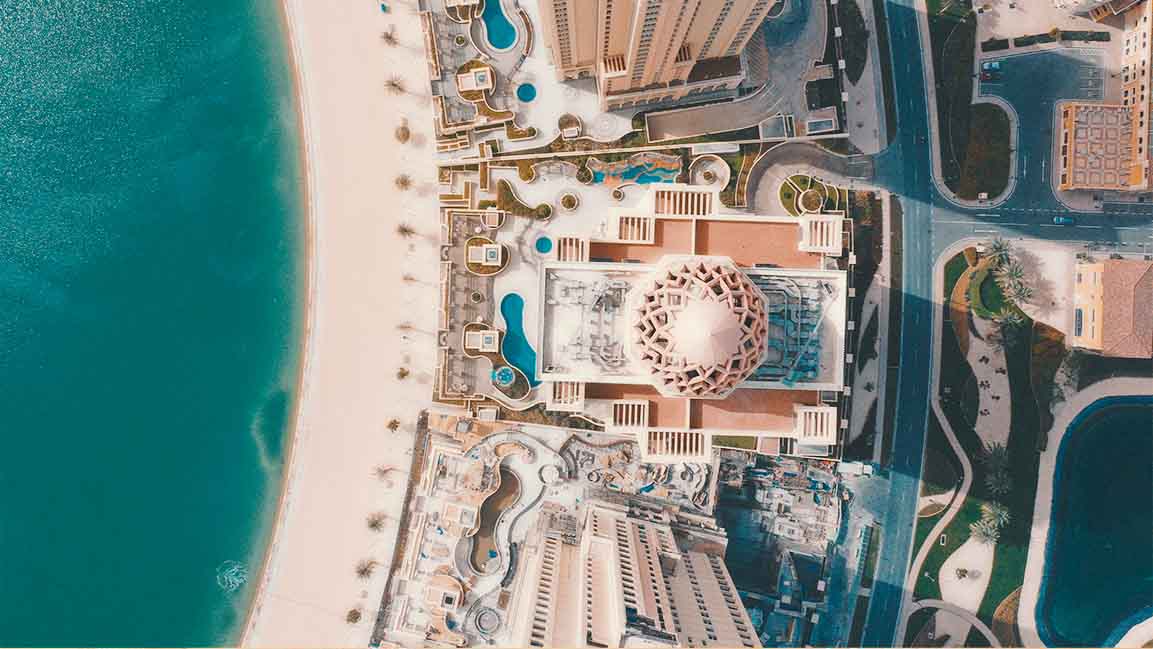

Since 2015, Qatar Airways has launched 70 initiatives to reduce fuel consumption and signed up for IATA’s turbulence awareness program. Under this, airlines across the globe share data about climatic conditions to help other carriers avoid turbulence, resulting in less energy use while navigating the skies. It has also pledged support for the World Economic Forum’s aim to ensure that Sustainable Aviation Fuels (SAF) make up 10% of the energy supply for jets.

Apart from its commitment to achieving net-zero emissions by 2050, Qatar Airways has also become the world’s first airline to make a transaction using IATA’s Aviation Carbon Exchange (ACE) platform. Airlines can buy and sell emission units through this marketplace to meet commitments to reduce carbon footprint.

Dubai-based airline giant Emirates has taken a more pragmatic approach, urging the aviation sector to stick to realistic targets. Its President Tim Clark, while speaking at IATA’s World Air Transport Summit in late 2021, called expectations of the industry cutting emissions by 40% in a decade unrealistic. As for real action, Emirates has worked with navigation service providers to map the most efficient routes and avoid headwinds to reduce fuel consumption per flight. The airline has also reduced discretionary fuel uplift through fuel monitoring tech and data analytics.

“Reducing emissions is one of Emirates’ priority focus areas under our environmental sustainability framework. This includes a policy of operating a young and fuel-efficient fleet, an ongoing comprehensive operational fuel efficiency program, and support for the UAE and international programs on sustainable aviation fuel,” says Shannon Scott, Emirates’ senior manager for Environment Affairs.

Emirates also deploys simple steps like using natural tailwinds, turning off a couple of engines while taxiing in from the runway, and burning less fuel by not using reverse thrust by engines for landing. As part of managing each flight’s weight to increase energy efficiency, the airline also uses AI to predict the uplift of potable water in each flight.

“Emirates has committed to implementing the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). CORSIA, established by ICAO and implemented by ICAO member states including the UAE, is designed to stabilize international emissions at 2019 levels over the medium term while providing additional incentives for introducing sustainable and low carbon fuels,” adds Scott.

HEAVY EMITTERS TRYING TO CAGE CARBON

Whether by operations within the industry or using fossil fuels in everyday life, the oil and gas sector accounts for a massive 42% of the total emissions, which translates to more than two billion tons yearly. This means that the global energy industry’s commitment to reducing its carbon footprint demands drastic changes to its entire business model and adapting to the rise of unconventional energy sources. In the Middle East, Saudi Arabia and the UAE are the leading oil producers in the world, and with sanctions on Russia, demand for oil and gas from the Gulf has skyrocketed.

State-owned Saudi Aramco has a herculean task of reaching net-zero levels by 2050. For this, the company has promised to reduce carbon dioxide emissions by over 50 million metric tons annually and to capture 11 million tonnes of CO2 every year by 2035. But the company, while committing to reduce emissions from its operations, doesn’t mention Scope 3 emissions caused by people burning fossil fuels supplied by it.

Carbon capture or sequestration is the process of catching carbon emitted from large scale operations such as factories or power plants to store it and thereby prevent pollution and impact on the atmosphere. Aramco’s scientists have also worked for almost a decade to refine mobile carbon capture tech, which takes CO2 from a vehicle’s exhaust and brings it in touch with solvents. In the process, it emits nitrogen, water vapor, and CO2 while storing most of it in a tank on the vehicle.

“We are investing for the long-term, against a backdrop of global energy and economic uncertainty, and we will continue to integrate breakthrough technologies in our operations over the next decade and beyond,” says Amin H. Nasser, Aramco president & CEO.

As part of its sustainability strategy, Aramco is also working on scaling up production to generate 11 million tonnes of blue ammonia and 2 million tonnes of blue hydrogen. Blue hydrogen is created upon separating carbon from hydrogen by steam methane reforming and capturing carbon to be stored. But the catch here is that drilling for natural gas, used in producing blue hydrogen, causes fugitive emissions through methane leakage in the atmosphere.

Aramco’s counterpart in the UAE, state-owned ADNOC, is another major oil producer in the Middle East, which has committed to reducing greenhouse gas emission intensity by 25% by 2030. For this purpose, the company will increase carbon capture utilization and storage capacity by 500% and increase carbon capture from 800,000 tonnes to five million tonnes annually.

To boost sustainability further, 99% of the water used by ADNOC for cooling is seawater, which flows back into the ocean after operations. At the same time, freshwater consumption will also be slashed to 0.5% of ADNOC’s total usage. In line with Aramco’s efforts, ADNOC has joined Masdar to pick up a 25% stake in British Petroleum’s blue hydrogen project in the UK. The firms will also work on establishing a blue hydrogen generation facility in Abu Dhabi.

BALANCING GLOBAL DEMAND AND CUTTING EMISSIONS

Notable initiatives and schemes seem to be on track to control and capture emissions. However, these oil giants are also expected to fill the gap. Given the contrasting situations, will the goals of cutting emissions be achieved?

“Our ambition is to achieve operational net-zero by 2050, and our sustainability report highlights how we aim to continue meeting the rising energy demand while also contributing to the broader energy transition,” adds Nasser.

Apart from these two major sectors, the Middle East’s retail industry is also stepping up to reduce its environmental impact. The Majid Al Futtaim group focuses on reducing water consumption and carbon emissions to become net positive by 2040. The retail giant has set a bold 37% absolute operational carbon and water footprint reduction target for each operating company by the end of 2022.

Smart systems fueled by data analytics and AI can boost organizations’ efforts to achieve net-zero ambitions. “AI can help tailor and optimize processes to reduce the carbon footprint across the organization. The possibilities cover a wide span of areas, including actions targeting the mitigation of emissions and the adaptation and resilience of the organization,” says Awad.

These commitments envision the future of the Middle East through green tinted glasses, but implementing strategies remains a challenge for major emitters. In contrast, smaller emitters such as airlines appear to be more on track to achieve their goals. In such a scenario, it remains to be seen how much impact the emission cut targets set by firms across the region will have on climate action.