- | 11:30 am

Saudi Electricity secures $567.5 million for interconnection project with Egypt

The Saudi Electricity Company has raised over $3.56 billion in funding for multiple projects

The Saudi Electricity Company has obtained $567.5 million to support the Saudi-Egypt electricity interconnection project. This round was financed by Swedish Export Credit Corporation, Standard Chartered Bank, and Sumitomo Mitsui Banking Corporation.

According to the company, this is a 14-year funding facility guaranteed by the Swedish government’s export credit agency.

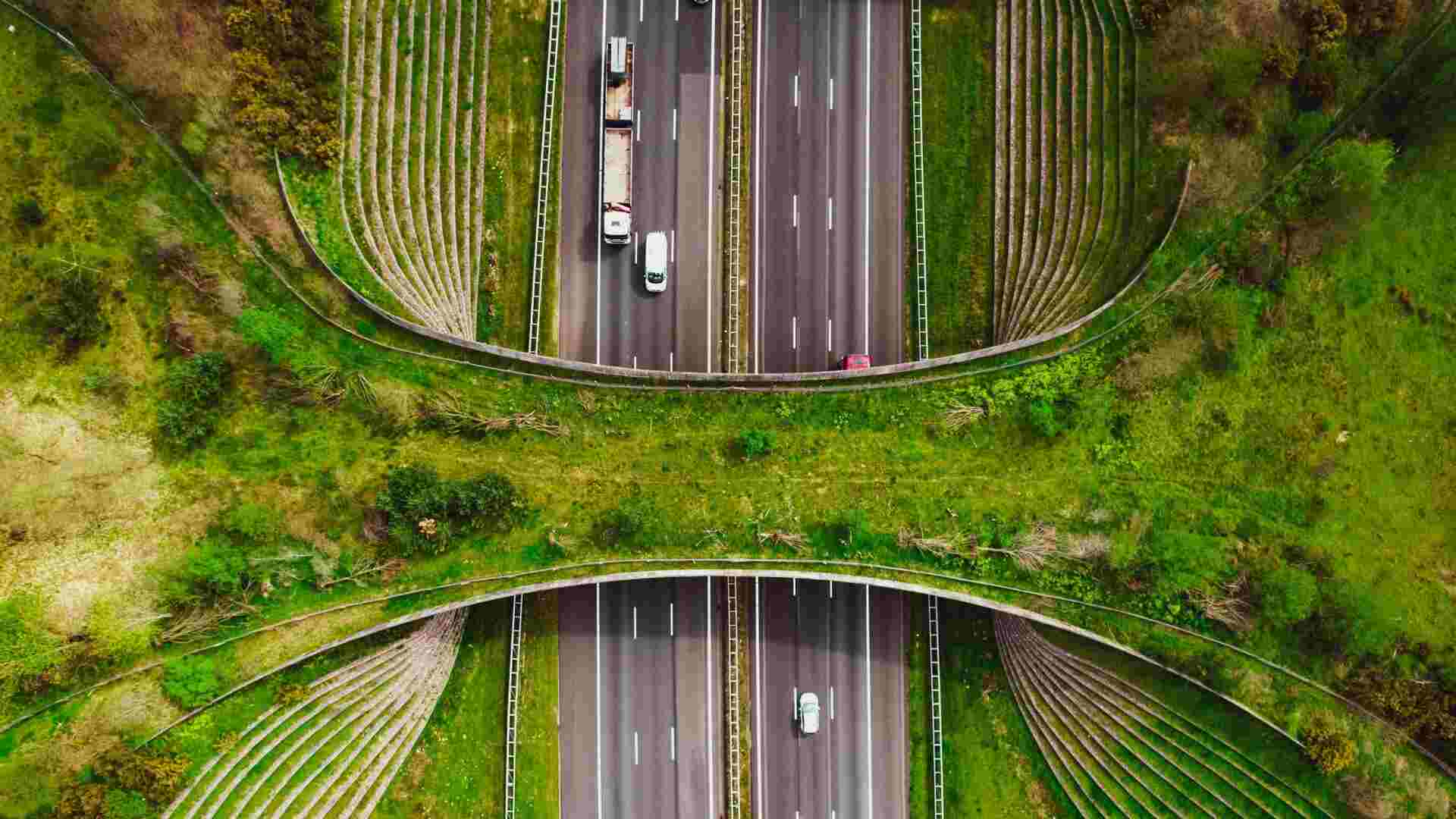

The Saudi-Egypt electricity interconnection project is an electrical interconnection project that aims to create an infrastructure for electricity trade between Arab countries. This project is expected to be completed by 2026 and will provide 3000 megawatts of electricity to Egypt at the cost of $1.8 billion. Earlier in June, Saudi Arabia and Iraq also initiated a similar project of interconnecting their electricity systems.

Saudi Arabia already has a strong economic tie-up with Egypt, and the kingdom has established a dedicated company to help explore investment opportunities in the country. This company recently acquired a stake in 4 Egyptian companies for $1.3 billion.

In a related piece of news, the Saudi Electricity Company (SEC) has signed another agreement to obtain a $3 billion syndicated loan from 15 international banks. This unsecured facility covering a five-year tenor will be used to refinance an existing syndicated facility scheduled to mature this month.

The banks are Standard Chartered Bank, HSBC, Intesa Sanpaolo, Mizuho Bank, MUFG Bank, Sumitomo Mitsui Banking Corporation, Industrial and Commercial Bank of China, State Bank of India, Bank of China, Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, First Abu Dhabi Bank, National Bank of Kuwait, KfW IPEX-Bank and Societe Generale.

The facility will also fund the company’s capital expenditure needed to achieve long-term growth for both the business and investors, SEC said in a prepared statement.

Most Innovative Companies comes to the Middle East this October! Click here to know more.