- | 9:00 am

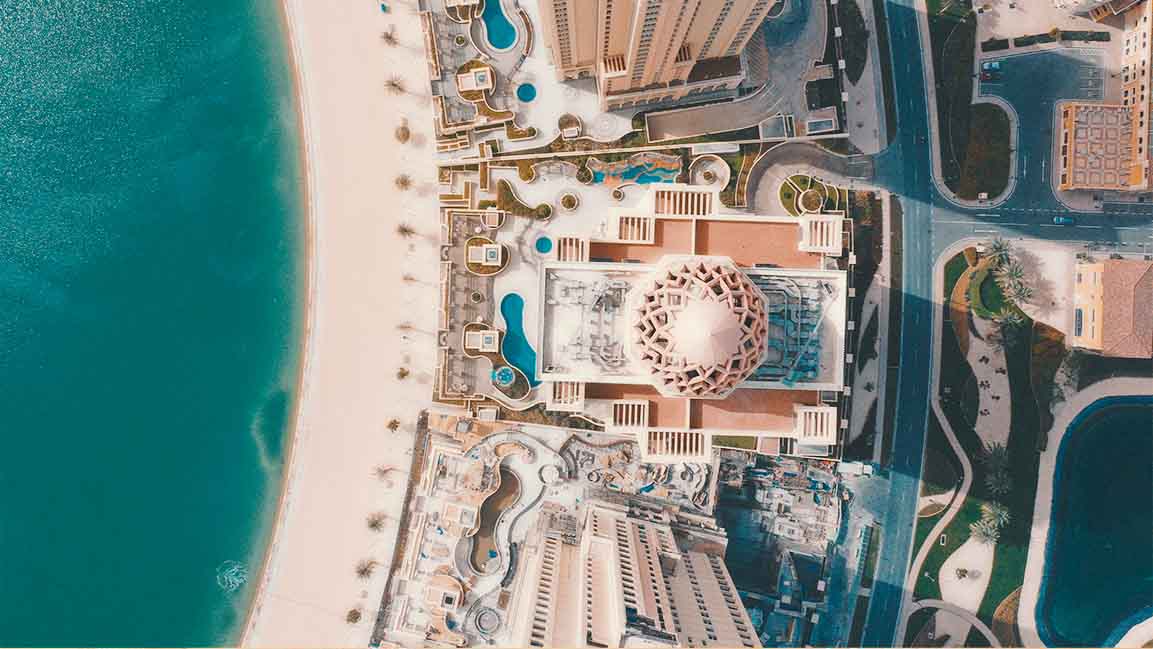

For gaming companies, the Middle East seems to be a checkpoint. Will they win?

With a young and tech-savvy demographic, the outlook of the gaming industry in the region is buoyant

During the pandemic, with people stuck indoors, video games had an unprecedented boom – every facet of gaming, from mobile to consoles, was given a boost.

Now that people are heading outdoors again, many claim that behavior is set to change, and interest in games may dip. In fact, in the three months that ended June, Microsoft, Sony, and Nintendo each posted disappointing results in their gaming businesses. Ongoing shortages of semiconductor equipment haven’t helped either.

But companies and investors aren’t cutting back in the Middle East. Far from it.

Consider Abu Dhabi Gaming which is building a self-sustaining gaming and esports ecosystem in the emirate. “We are welcoming more and more game developers to expand their operations in Abu Dhabi,” says James Hartt, Director of Strategic Partnerships at Abu Dhabi Gaming.

Then there’s Saudi Arabia’s sovereign Public Investment Fund (PIF) investment that has had its hands in so many notable deals its portfolio looks like the who-is-who of global gaming companies came together for a dinner party. “PIF has invested over $3 billion in 2022 to develop the sector,” says Saeed Sharaf, Founder and CEO of eSports Middle East. The PIF recently acquired a stake in Nintendo and Embracer and has investments in Capcom, Activision Blizzard, EA, and others.

“So far, in 2022, gaming startups in MENA have raised $16 million from seven deals. It’s already higher than the $15 million in the entire year of 2021,” says Philip Bahoshy, founder and CEO of MAGNiTT.

The Middle East and Africa region have been a growing market for video games for years. Ubisoft, Minecraft, and Fortnite count young people from the region among their most ardent fans. Tencent Games opened its regional headquarter in Dubai Internet City.

“The market is strong in the UAE, with gamers’ spend per capita by far the largest in the region and one of the highest in the world,” says Hartt.

In 2021, Saudi Arabia headed the list of MENA countries with the biggest consumption of video games, as the market hit $1 billion.

The number of gamers in the region keeps going up as smartphones, PCs, and consoles become available to more of the region’s population. A recent survey revealed that 50% of Saudi Arabia’s population define themselves as regular gamers.

“Even though gaming is booming in the region, local video game development and esports are still relatively nascent, especially compared to the US or Europe. Saudi Arabia is a rapidly growing market – the 19th biggest globally,” says Brian Ward, CEO of Savvy Gaming Group (SGG) and a former Activision Blizzard executive with over 26 years of experience in esports and gaming. SGG is an esports and gaming investment company funded by the PIF.

“Video games are a massive part of Saudi youth culture and gaming, and esports consumption in Saudi Arabia has been forecasted to reach $6.8 billion by 2030,” adds Ward.

Explaining the region’s gaming industry is one of the best to invest in, Ward says the MENA market has more active gamers than either the US or western Europe. “Also, the countries in the region have large youth populations with increasing disposable income and access to video games. Taken together, it’s easy to see why it’s one of the best regions to invest in the video games industry right now.”

The number of gamers from Saudi Arabia, the UAE, and Egypt are expected to climb to 85.76 million in 2025.

“As the number of players and teams within the region grow, investors are turning an eye to the sector,” says Sharaf. “Businesses have begun to sprout up to address opportunities within esports, from training and esports academies to esports events and festivals.”

Even as the pandemic lockdowns that powered their businesses over the past two years have been lifted, video game companies declare they still plan to go full steam ahead. It’s a counterintuitive bet. But some global companies are deploying money to the MENA gaming industry.

“The gaming market here is a force to be reckoned with, and the spoils of battle go to the early adopters,” says Nazih Fares, Head of communications and localization at The 4 Winds Entertainment, a Netherlands-based game publisher “All of our games are planned in MENA with as much effort as we would in Europe, with localized content.”

With the size of the MENA gaming market projected to increase to more than $5 billion by 2025, the space is getting competitive.

“We already see much more international interest from publishers and developers and more investment in the region. There is a huge amount of potential to be unlocked,” says Ward.

“This, in turn, will encourage and facilitate increasing numbers of talented industry professionals to relocate to the MENA region; professionals who will bring with them a wealth of knowledge and play a vital role in helping to build and develop the future video game industry.”

GROWING LOCALIZATION

The gaming industry’s growth is fueled by two things—the localization of global gaming content and the local development of content tailored to the region, says Hartt. “This can help companies tap into the huge and underserved regional market.”

The 4 Winds Entertainment’s next title, WW3, has an Arab soldier with authentic voice lines inspired by local armies vs the stereotypical tropes of rebel fighters. Ubisoft, the French studio behind Assassin’s Creed, capitalized on the franchise’s popularity in the region and released the game with Arabic speech, subtitles, a localized user interface, and, of course, its protagonist ltair Ibn-La’Ahad. Even the Deus Ex series has a skilled Arab women pilot Faridah Malik.

Game studios in Saudi Arabia and Jordan have emerged in the last decade as localization became more popular. Jordan’s Tamatem has specialized in localizing internationally renowned games, adding date fruits to tables inside the game and Islamic decorations during Ramadan to suit Arabic-speaking users better.

“Arabic is in the world’s top five most spoken languages, and we are already seeing an increase in the number of video games translated to accommodate this important market. Gaming is all about accessibility and inclusivity, so even if some developers only create games with Arabic language options, it’s still a win for the consumers,” says Ward.

“English to Arabic translations of games have shown excellent investment potential, and we are also starting to see an increase in positive Arabian representation in video games such as the famous Altaïr Ibn-LaʼAhad from the original Assassins Creed game, for example. Outside of games, we’re seeing broader geek culture moving in the right direction, such as the Disney series Ms. Marvel, which has received positive feedback,” he adds.

ESPORTS HAVING ITS MOMENT

While from Riyadh to Cairo are dotted with video game cafes emblazoned with Call of Duty characters, esports is seeing high demand in the region. International tournaments and the growth of different leagues have fuelled the Middle East region’s acceleration into the esports sector.

“You only need to look at the massive Gamers8 festival in Riyadh that is currently taking place to see how passionate the fans are,” says Ward.

At such esports events, big companies are finding ways to engage directly with their target audience and, at the same time, create quality digital content and memorable fan experiences. For example, at the eight-week esports event Gamers8, Spotify is connecting the players through music where fans can access curated music playlists, a collaboration between Spotify’s music team and Gamers8 gaming professionals.

“Audio is playing a bigger role than ever in video games—from introducing catchy anthems to influencing listening habits long after gamers log off. Our Saudi Arabian audience has a tremendous level of engagement with gaming to music. With over 40% of its music streaming on consoles, Saudi Arabia is our number one country that streams on consoles at the highest rate,” says Nicole Aoun, Marketing and Partnership Manager, Spotify.

“Every victory and every defeat they experience in the game has a soundtrack, which they see as a boost for their gaming experience.”

Harrt says esports is growing “twice as fast” in MENA than the global average. “We’ve seen from the impressive takeup of esports events.

AD Gaming is bringing Blast Premier World Finals to UAE’s capital in December while supporting a year-round calendar of events at locations such as the AlQana esports arena. “This will be the Middle East’s biggest ever esports competition – with well over a million viewers tuning in online to see some of the world’s best teams competing for over $ 1 million prize money,” says Hartt.

As per Sharaf, the region was late in its adoption of esports compared to the rest of the world; however, “the fervor for esports has grown exponentially as more tournaments have provided an increasing number of players and teams the opportunity to participate and win.”

IMPACT OF METAVERSE AND BLOCKCHAIN

The gaming industry will only gain more significance as more advanced tech such as virtual and augmented reality and metaverse are adopted. “While esports is becoming more immersive via AR and VR, the metaverse will provide superior engagement and monetization in the gaming industry. These are indeed hugely exciting times for esports and gaming,” says Faisal Bin Homran, Head of Esports, Saudi Esports Federation.

While gaming will grow in popularity, the mechanism of fair and competitive titles as part of esports within the metaverse will be subject to how advanced the VR equipment is, says Sharaf.

Will VR and AR equipment be able to offer pro players adequate levels of input latency, refresh rate, and game control functionality? Only time will tell.

“The integration of esports with the metaverse goes beyond competitive VR sport in a realistic 3D virtual environment,” adds Sharaf. “It opens up the possibility of shifting in-person, physical tournaments to virtual environments – thus, opening up the possibility of a lot more viewers and spectators being able to watch from anywhere in the world, from any angle they prefer.

Blockchain technology is also transforming in-game microtransactions, disrupting and revitalizing the traditional gaming industry. Gaming models based on real asset ownership and a new “play-to-earn” structure are emerging in abundance. “With this technology, money spent in a specific game title need not be lost entirely when the player moves on to another game; NFTs and asset ownership are changing all this. NFT technology and the underlying blockchains provide the means for gamers to earn assets that have real-world tradable value,” says Hartt.

IS THE INDUSTRY INCLUSIVE?

While all this is good, there are too few women in the gaming industry.

Esports athlete Madiha Naz says, “Women in the region are not provided as many opportunities as men. When it comes to the player base, there is yet to be a female in a top tier team.”

“This needs to change because once esports is at its all-time high in the region, the lack of representation of women will not be unnoticed. The region needs to have a strong focus on nurturing female talent as there is a great amount,” adds Naz.

To make the gaming industry more inclusive, AD Gaming partnered with female-led gaming businesses Boss Bunny.

“The nature of esports means that women and men of all abilities can play together and compete in the same tournaments. Esports allows for much more diversity than traditional sports, so we actively encourage women and girls to participate in all esports tournaments in Abu Dhabi. It is a truly inclusive sport,” says Hartt.

According to Hartt, a large part of building up a diverse and booming industry is ensuring that there are talent development opportunities for everyone. “We have worked with a number of leading universities in the UAE to promote video game development as a career for both young men and women,” he says.

MOVING BEYOND ENTERTAINMENT

Gaming moves beyond entertainment and is increasingly used for education and learning. “As more gamers and creative enthusiasts enter the industry, we can certainly expect the market to develop rapidly in the coming years. This will also be a crucial driving force in attracting game and interactive content developers to the region,” said Ammar Al Malik, Managing Director of Dubai Internet City and Dubai Outsource City.

Hartt agrees gaming holds untapped potential. There was an exponential rise in demand for gamified learning during the pandemic as education became digital. “The benefits and opportunities are now being much more fully understood. More and more game developers are focusing on this area, which will continue to grow,” he says.

How people play games have changed dramatically since Pong ushered in the era of video games half a century ago – but it is clear that people pretty much always want to play them – especially in the Middle East – even with lockdowns lifting and inflation running hot. There’s no sign of slowing down anytime soon. “We’re only at the beginning,” says Ward.