- | 9:00 am

These two UAE fintech startups are promoting financial inclusion

Driven by the diverse financial needs in the region, the fintech segment promises to be full of opportunities.

The severe earthquake in Nepal (in 2015) affected almost 8 million people. Many lives were lost, several were injured, and a huge number of people were left vulnerable. Noor, a UAE-based migrant worker, lost her home and a small shop that sustained her family. Having no one to turn to for financial support, she asked her employer for a “hefty loan.”

Financial exclusion impacts people’s quality of life, leaving them with limited safeguards when faced with a challenging situation. Whether that be a job loss, ill health, or more, it also prevents them from investing to secure their future. Alongside ramifications for individuals, financial exclusion impedes the growth of economies.

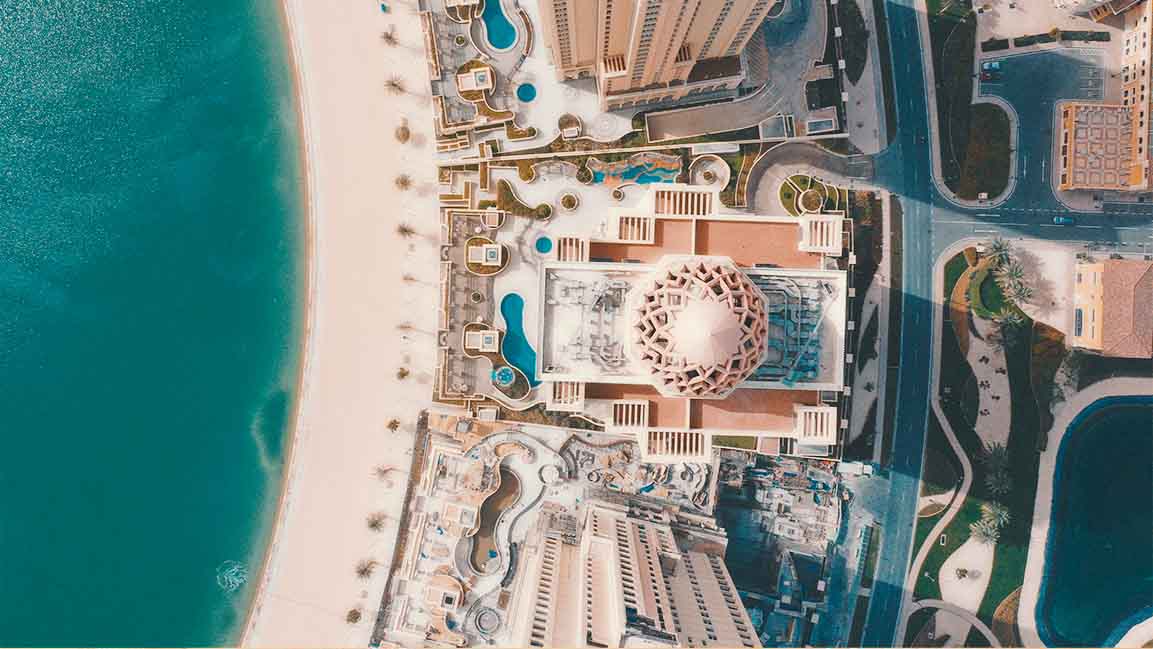

Even as access to financial services is crucial, almost 50% of the Middle East population remains financially excluded. A chunk of this “unbanked” population are migrant workers who regularly remit a significant portion of their income to support families back home.

For perspective, $43 billion in remittances were sent from the UAE in 2020 by expatriates (including migrant workers), according to the Global Knowledge Partnership on Migration and Development (KNOMAD).

But when faced with unforeseen challenges, the “unbanked” migrant worker population is left completely vulnerable. This incident would trigger the inception of not one but eventually two UAE-based fintech startups, Rise and Xare built with the promise to make banking solutions more accessible. Led by Padmini Gupta, both startups are driven to create a “fairer” financial ecosystem.

When Gupta’s house help asked her for a loan, she realized that similar conversations might be happening in many households between migrant workers and their employers. “Whether or not these workers ultimately receive financial support is dependent on their employers. I felt an urgency to change this by making financial products accessible to migrant workers,” she recollected. This led to the launch of Rise in 2017.

Over the years, Rise expanded its proposition for an erstwhile unbanked segment by giving them access to bank accounts, insurance, and Buy Now Pay Later (BNPL) credit products.

FINANCIALLY ENABLING COMMUNITIES

The migrant worker population in the region has many financial dependents who need money to sustain their basic needs. Standing in long queues outside remittance centers every month on their salary day is common in the region.

Gupta’s second startup Xare enables income earners in the MENA region and globally to share their financial access with dependents at any time from anywhere. Since its launch in January 2021, more than 1 million users across 170-plus countries have shared over $350 million through Xare. The free-to-use app currently averages around 15,000 shares per day, and Gupta still sees a “10X” growth path.

“Globally, only about 40% of the population works, and 60% are financially dependent on them for their financial needs. In the MENA region, this split is 30% who work and 70% depending on the former for their financial needs. With Xare, we have supercharged the ability of income earners to create, share, distribute, and manage financial resources in a simpler yet safer manner,” Gupta said.

With the launch of Xare, products by Rise are now integrated within the app, building, scaling, and helping migrants and other income earners globally. The transition has brought significant change, proving how social impact startups can scale, attract new investors, and positively disrupt the fintech space.

FUTURE OF FINTECH: OPPORTUNITIES AND OBSTACLES

According to RedSeer, 220 deals were closed in the digital economy worth $2.1 billion last year. Fintech accounted for a quarter of the transactions (52 deals) and 29% of the deal value ($600 million). As fintech startups gain significant investor attention, the segment promises to be full of opportunities.

The region has diverse financial needs. The GCC is home to some of the wealthiest people globally. At the same time, millions of modest income migrants live here and send most of their income back home. Somewhere in the middle are the working-class Arabs and expatriates. “Due to such diverse financial needs, we see the opportunity to build different types of financial solutions and products. It ranges from wealth management tools and migrant financial solutions to neo-banks, BNPL providers, and SME financing.”

As new fintech players emerge in the region and scale, there is a need for regulatory clarity and homogeneity.

According to Gupta, while the MENA region is home to almost $2 trillion of spending, it is heavily fragmented, with divergent regulatory playbooks posing a challenge to scaling and sustaining fintech.

“Having said that, there has been a sea change in the regulatory landscape in the last four to five years with the emergence of several sandboxes, coupled with the active role played by innovation hubs like Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM). Even though fintech is much better understood and has more regulatory clarity in several markets, there is still a lot that needs to be done.”

For instance, a key obstacle to potential fintech is the lack of effective multi-market banking-as-a-solution (BAAS) options, she continued. “Even though several fintech entities attempt to build the regional plaid, most services are still limited and not multi-market. This has prevented the growth of fintech that we have seen in other geographies.”

“Another peculiarity in the region has been that fintech solutions like BNPL that do not depend on banking partners have taken off and scaled better. As the banks’ willingness to partner evolves, so will the ability to build deeper integration products like niche segment neo banks. The region is on the cusp of a fintech Cambrian explosion with hundreds of fintech companies serving every niche across markets within the coming decade.”

Availability of growth capital and the ability to compete with international players moving into the region will also be vital to creating a thriving and sustainable fintech ecosystem in the MENA region.